Small Business Owners

From Small Business Owner to Your Financial Partner

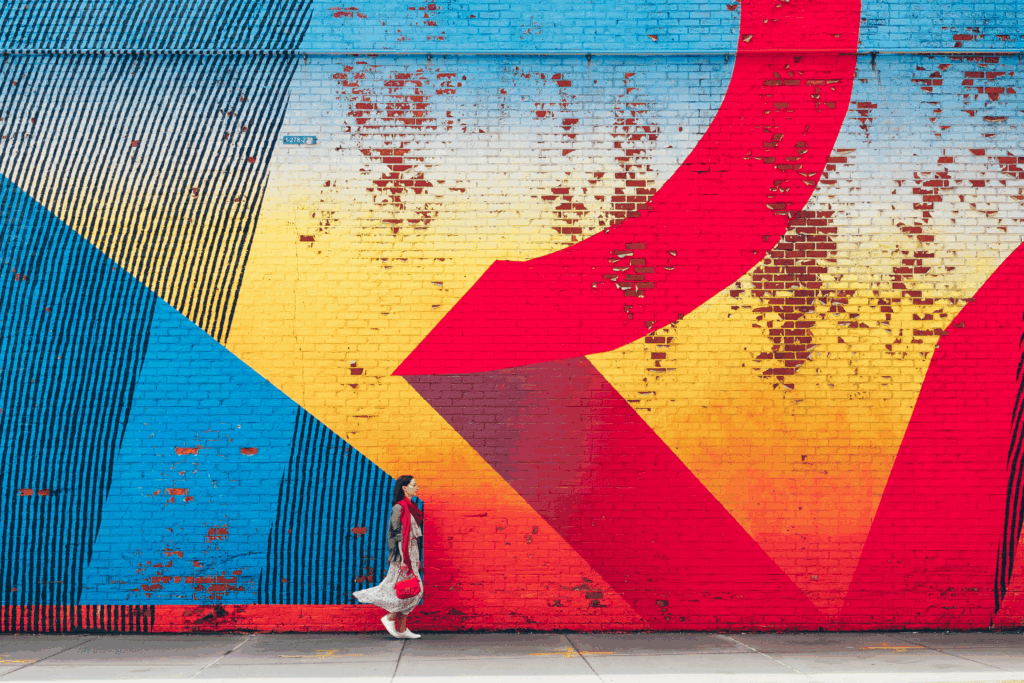

Ann knows firsthand the challenges and rewards of running a small business. After building her own financial planning practice from the ground up, she understands the balancing act between growth, stability, and personal well-being. Her experience enables her to guide fellow entrepreneurs toward financial clarity, supporting both their business ambitions and personal goals.

- Ann founded and grew her own independent financial planning firm.

- Making sure no part of your financial big picture is being ignored in the whirlwind of business ownership.

- Your business has a Chief Financial Officer; Equila can be your family CFO, taking care of the personal side of your money while you focus on your business.

Strategies for Your Business and Beyond

Running a business means your personal and professional finances are deeply connected. Ann’s approach to working with small business owners focuses on creating a plan that integrates business growth, personal wealth building, and long-term security. She offers guidance that adapts to your goals—helping you make confident decisions in every stage of ownership.

Cash Flow and Tax Planning

Ann offers strategies to manage income, reduce tax burdens, and reinvest in your business.

Employer Retirement Plans

Ann provides solutions that benefit both you and your employees while supporting your future financial independence.

Exit and Transition Planning

As a member of your professional team, Ann provides recommendations on the financial consequences of a business transition, and coordinates with your attorney and tax professionals.

A Plan Designed Around You

No matter where you are on your financial journey, we’re here to listen, analyze, and help you take the next steps with confidence. Together, we can transform your goals into a personalized financial plan that aligns with your life.

Solutions That Work for You and Your Business

As a business owner, you need financial strategies that support both your company’s success and your personal financial well-being. Ann offers personal financial planning and wealth management that take into account the challenges and rewards of owning a small business, helping you to maintain a healthy work life balance in your financial situation. Her guidance is practical and rooted in real-world experience.

Stand-Alone Financial Planning

A focused plan tailored to your unique goals, whether that’s improving cash flow, preparing for expansion, or balancing business and personal priorities.

Full Service Wealth Management

Empowering Your Financial Journey

Owning a business is more than a career—it’s a commitment of time, resources, and passion. Ann understands the weight of that responsibility because she’s been there herself. She knows how to navigate the complexities of balancing business growth with personal financial security, and she’s here to help you achieve both with confidence.

Firsthand Experience

Ann has lived the challenges of starting and running her own business, giving her unique insight into your journey.

Strategic Planning

Ann helps align your business goals with your personal financial objectives, ensuring both are moving in the right direction.

Transition Support

From succession planning to selling your business, Ann guides you through life’s big decisions with foresight and care.

Insights For Small Business Owners

Navigate the unique financial challenges of entrepreneurship with guidance tailored for business owners on our “Ann-splaining” blog.

Get In Touch

Want to know more? We offer a free, no obligation, “Get Acquainted” meeting to share what you are looking for and what I do to see if there’s a match. Contact us by phone or email, and tell us more about yourself and your financial concerns, and we will get back to you!